Imagine a time before cell phones, robotic vacuums, real-time weather alerts or even our current savior: online shopping. It wasn’t that long ago when none of these existed…

Technology has become engrained in our DNA. We rely and depend on it every day in all aspects of our lives. It is meant to improve how we live and work, and enable our daily tasks to become more efficient, convenient, and fulfilling.

For the past few decades, the retail industry has led the technological revolution. They have done this out of competitive necessity to survive. Either you adjust to the changing consumer demands, or you begin a quick journey into irrelevance. Obviously, the recent COVID outbreak has exposed those that didn’t adjust soon enough.

In the banking industry, there is a different story, a different consumer mindset that up until recently didn’t have the same expectations of financial institutions (FIs). It is easy to shop at a different grocery store, clothing retailer or online merchant. But consumers generally haven’t changed FIs without a specific reason. Well, COVID has begun shedding a light on the financial industry’s inability to adapt now too…

This is not to say the financial industry has not had many impactful technological advancements—it has. The issue is the disparities between how far along the technological maturity curve different FIs are. Beyond all of the economic and regulatory challenges banks are facing, they now have to dedicate much more attention and resources to solving the same kind of consumer-demand dilemma that retailers have been grappling with for years.

It’s an omnichannel world, we’re just living in it.

To really understand the severity of the problem, we should begin with the issue facing FIs in the early stages of their technological maturity curves. Many of these FIs have online banking, mobile apps, and possibly some ATMs. They are able to service their consumers digitally but are still forcing them to come into the branch for most of their transaction needs.

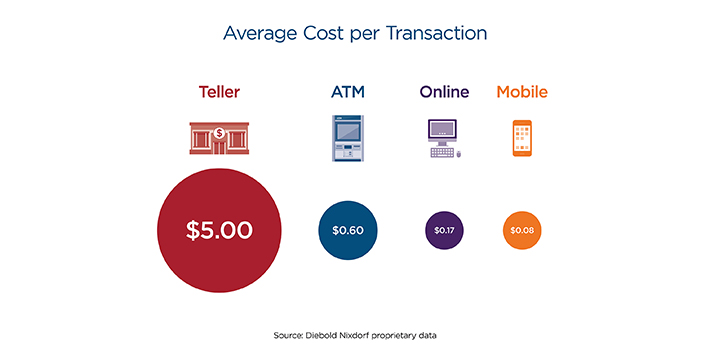

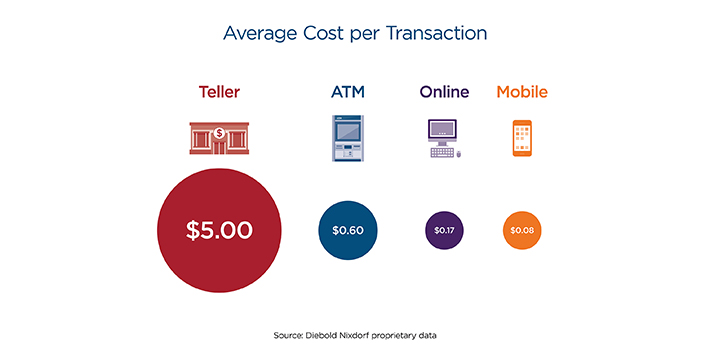

When you consider the cost of executing these transactions, you must ask yourself if there isn’t a better way. Especially in today’s banking environment where FIs are getting hit with cost pressures from all angles. The online and mobile channels are great, but they won’t solve for cash. This is where the ATM can fill a real void, specifically an ATM that accepts deposits. Offering (at minimum) deposit capabilities through your self-service channel can help drive costs out of the network. This will help improve your expenses and ultimately your efficiency ratio. Yet there are still hundreds of FIs around the country that do not have this offering.

The times, they are a’changin'.

The times, they are a’changin'.

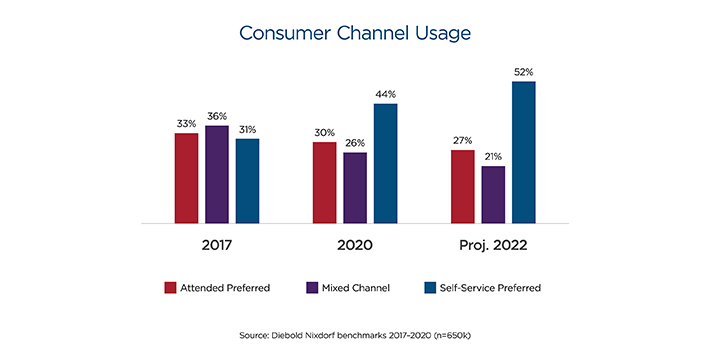

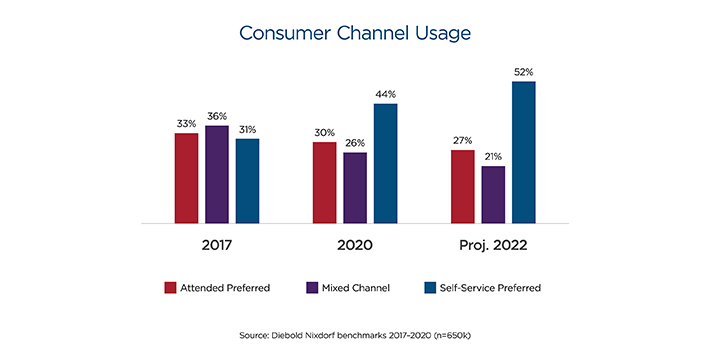

Next we must consider the consumer and what they want. We already know consumers are becoming more comfortable with self-service technologies in other industries, and banking is no different. Consumers have quickly migrated to the self-service channels when their FIs have offered it and their channel preferences are rapidly changing. From 2017 to early 2020, there was a 13% rise in self-service preferred channels per Diebold Nixdorf research. This was expected to increase to over 50% in the next two years, and this was prior to COVID! This is a telling factor that consumers are asking for more ways to bank. They are asking for more efficient and convenient options to bank on their time, with the transaction sets they need to conduct. By not accepting deposits at the ATM, FIs are essentially forcing consumers to the most expensive channel. Meanwhile, the early deployers of DA are now seeing a huge opportunity to further reduce costs by recycling cash deposited at the ATM.

What’s your migration strategy?

What’s your migration strategy?

A third component that FIs often neglect to consider enough is the employee experience. In a branch environment that is transaction heavy, the staff are busy churning through transactions as quickly as possible. They also need to spend time processing checks, handling and balancing cash drawers, completing vault buys and sells, handling discrepancies, and oh yeah—identifying opportunities for referrals or cross-sells. The most successful FIs recognized this issue years ago and their solution was to migrate as many simple transactions as possible out of the branch so their staff can focus on engaging more with consumers. Ultimately, that leads to better consumer satisfaction scores and an improved overall employee experience. A major driver of transaction migration is a deposit-accepting ATM.

As technology has improved, so have the

capabilities of the ATM. Merely having a deposit-accepting ATM is no longer the most efficient, convenient or fulfilling option. Consumers and branch employees alike do not enjoy using envelopes to deposit cash and checks. It simply isn’t a good experience for all parties and the cost to the FI for balancing is cumbersome. Deposit Automation technology creates the best overall experience and efficiency for migrating transactions out of the branch.

FIs that do not have ATMs with deposit automation are forcing their customers or members to transact on the bank’s time, not the consumer’s. And if we have learned anything from the retail industry, this is not an ideal long-term strategy… especially with the acceleration of our dependence on self-service through COVID.

If you’re still unsure if deposit automation is right for your organization,

download this checklist. You will see there is a wide range of benefits for you, your employees and your consumers.

Ready to get started on a customized DA strategy?

Schedule a consultation with our Advisory Services experts today!