Innovation, immediacy, flexibility, and interoperability are vital components in a blossoming instant payments industry poised to transform the global market. Asia-Pacific countries already dominate a sphere being rapidly reshaped by the adoption of common standards and increased demand for cross-border transactions.

Since the dawn of the smartphone era a growing hunger for faster payment technologies has begun to spark innovation in financial services. The global habit of instantaneous communication has been echoed by businesses and consumers demanding speedier transactions to keep pace with an advancing digital economy.

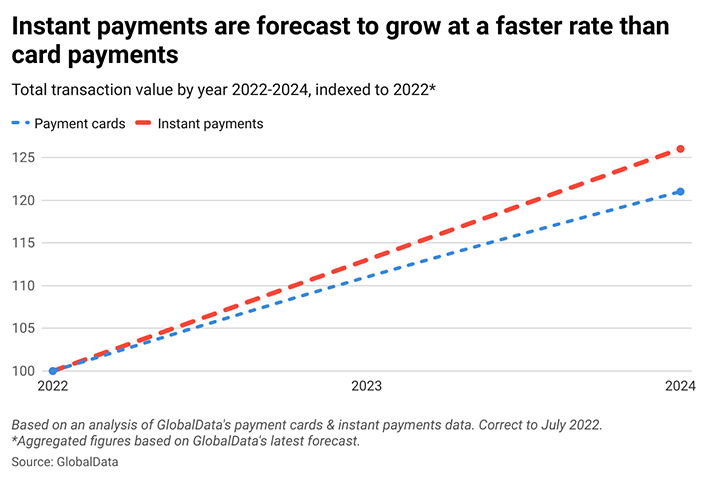

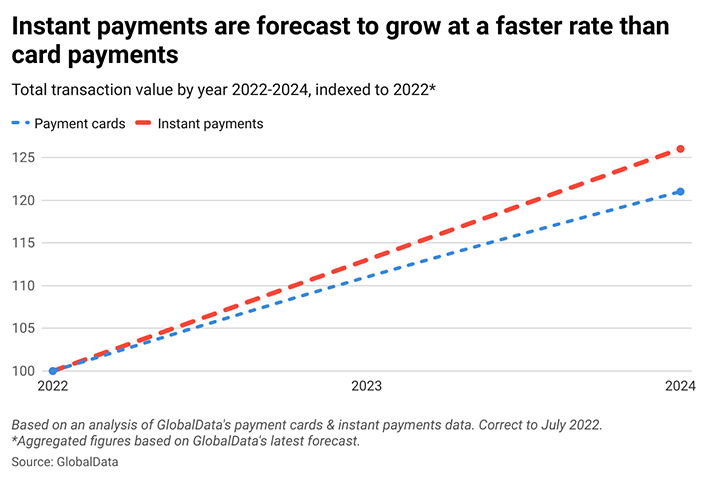

Research by GlobalData calls instant payments a “direct alternative” to payment cards which look likely to disrupt established networks whilst providing a range of benefits. These include “better cash flow management for merchants”, via reducing unpaid invoice risks, and incentives for consumer adoption like zero transaction fees for new customers. Although free instant payments are not expected to be sustainable long-term, GlobalData expects fees to remain lower than card transaction fees.

Some countries, merchants, and fintech companies are already capitalising on the opportunities presented by an increasingly mobile-first ecosystem set to transform the way consumers do business. According to GlobalData, India leads the way with its widespread adoption of instant payment systems (IPS), which could enable more consumers without bank accounts to participate in the digital transaction revolution.

Asia Pacific driving the revolution

Electronic Payments International’s (EPI) analysis of GlobalData’s instant payments database shows how Asia-Pacific countries are forecast to lead the global IPS market by a significant margin between now and 2025.

China is the clear market leader with an IPS market forecast to be worth around US$42tn in 2025. This is almost as much as the combined IPS transaction value for Japan and South Korea – China’s next two nearest competitors – in the same year.

Further afield

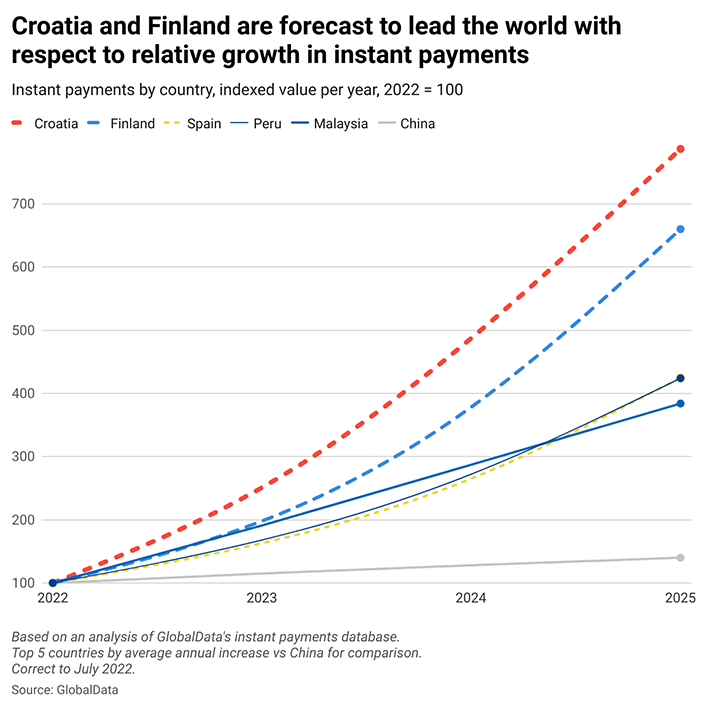

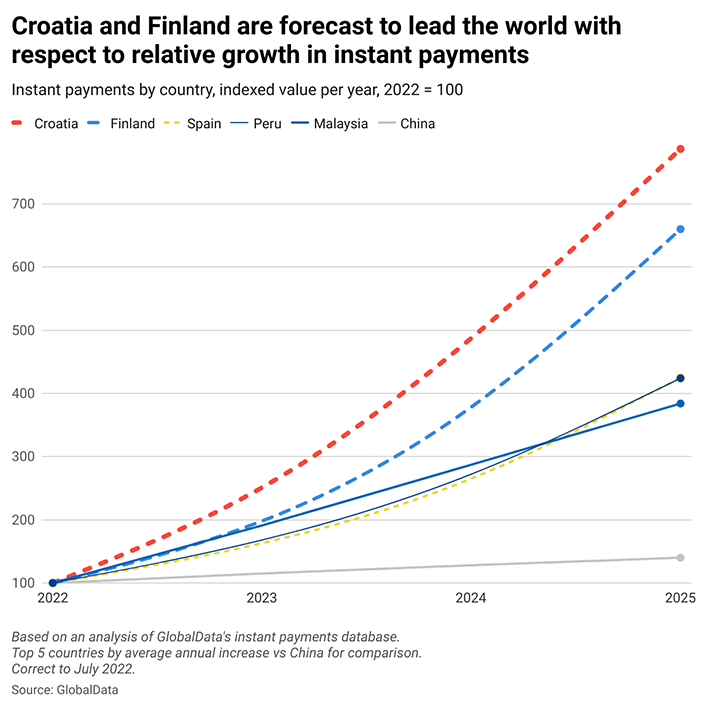

Despite being the global IPS titan, China’s growth rate in this space looks set to plateau compared to nascent markets like Croatia and Finland. Nevertheless, these and other emerging markets are expected to maintain steady annual growth beyond this point.

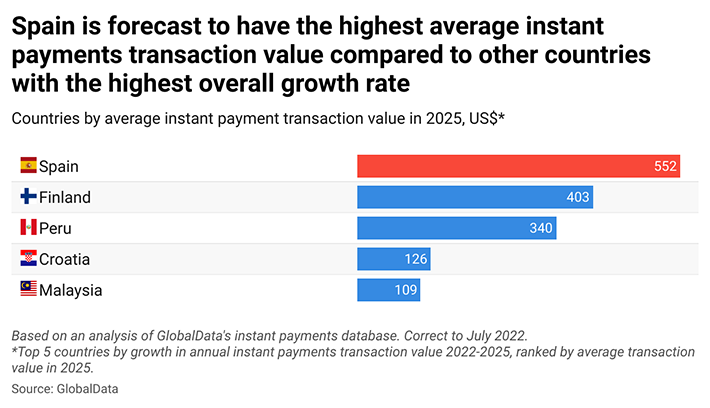

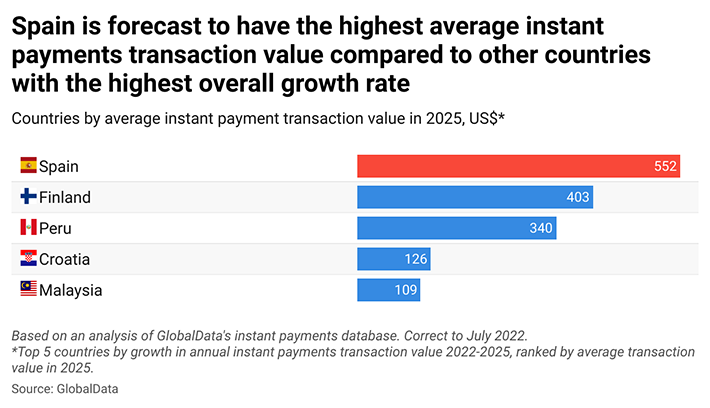

Of these top five countries, Spain is expected to race ahead in terms of average instant payment transaction value, surpassing Finland by almost US$150 per transaction by 2025.

Common standards

Common standards

As the global IPS market rapidly expands beyond domestic frontiers, new initiatives are required to ensure that distinct forms of IPS technologies from different countries can easily integrate with each-other to facilitate seamless transactions. GlobalData’s

research highlights the impact countries in the association of Southeast Asian Nations (ASEAN) are having in this sphere in terms of “showing significant progress” with respect to enhancing IPS interoperability. For instance, as recently as 2021 numerous ASEAN countries signed cross-border agreements to enhance and widen the scope of IPS tech across the region.

According to a

report by the World Economic Forum (WEF), a crucial milestone in the pursuit of interoperability is the widespread adoption of the

ISO 20022 standard, a universal financial industry message scheme succinctly described by the

Bank of England as a “common language for payments data across the globe”. The WEF expects this approach to enable the “development of new instant payment systems”, alongside facilitating “harmonization between payment systems”. It also promises to improve “operational resilience” and mitigate the effects of “market fragmentation” or “single points of failure”.

Other benefits outlined by the WEF’s analysis include a new capacity for automation, “straight through processing”, and “rich data opportunities to enhance data quality and financial crime compliance”. The WEF highlights China, India, Japan, Singapore, Thailand, and the Philippines as world leaders in the adoption of ISO 20022, with a notable focus on the potential for this – and other similar common standards – to enable interoperable QR codes for cross-border payments.

Next-gen payments

One of the companies looking to seize the opportunities presented by fresh payment paradigms whilst echoing the call to embrace common standards like ISO 20022 are Diebold Nixdorf, who are already renowned for their dominance of the global automated teller machine (ATM) market. Their

Vynamic™ Payments platform has been designed in a multifaceted way allowing it to leverage numerous unique advantages compared to legacy systems destined for obsolescence.

Cloud-native, low-code, and agnostic with respect to payment type, channel, or authentication method, Vynamic™ Payments is already disrupting the financial services and payments industry. The platform enables businesses and consumers to take advantage of innovative fintech products, whilst simultaneously maintaining access to current industry behemoths in the payments space like AliPay and Paypal. Banking and card payments can utilise it across any channel, encompassing everything from ATMs to physical point-of-sale (POS) units in a retail environment, e-Commerce, and digital wallet-based transactions.

Diebold Nixdorf are well aware of the importance of instant payments in emerging markets, particularly when it comes to broadening access to financial services. According to Bruce Diesel, Head of Product, Payments, Diebold Nixdorf: “In many markets like Africa and India, Instant Payments are an alternative to card rails. Card rails require formal banking, and many of these markets have significant underbanked populations.”

He added: “This started in 2007. UPI in India is very much driven by their need to provide banking services to underbanked.”

He also said that “one of the reasons why APAC is on the forefront is due to some of these dynamics” and cited an African innovation called

M-pesa as “one of the most successful” examples of IPS being deployed in areas where most of the population have mobile phones, but not necessarily bank accounts.

Parallel markets

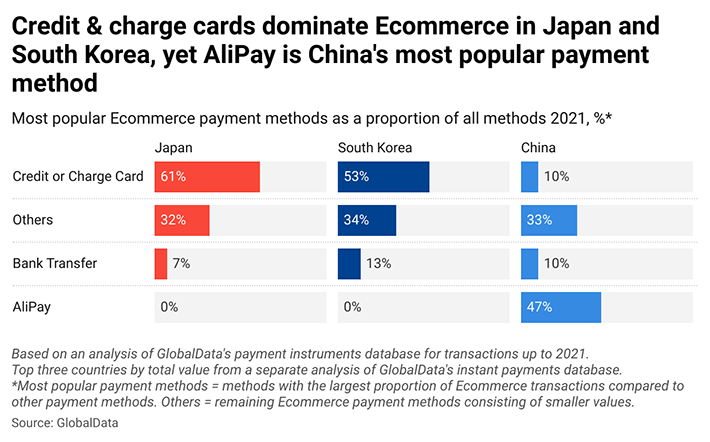

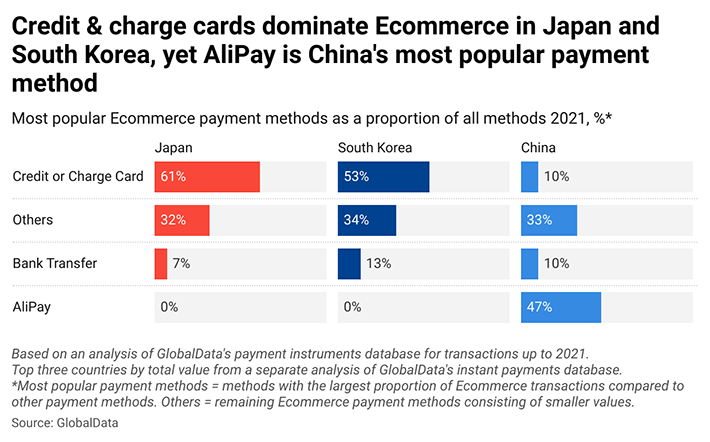

As financial services embrace the drive to digitisation, instant payments could begin to penetrate established markets like card payments and overtake existing E-commerce payment instruments. According to EPI’s analysis of GlobalData’s E-commerce database, two of the world’s largest instant payments markets remain heavily reliant on cards for online purchases. Japan and South Korea are dominated by credit or charge cards, whereas Alipay has the largest overall share of the market in China.

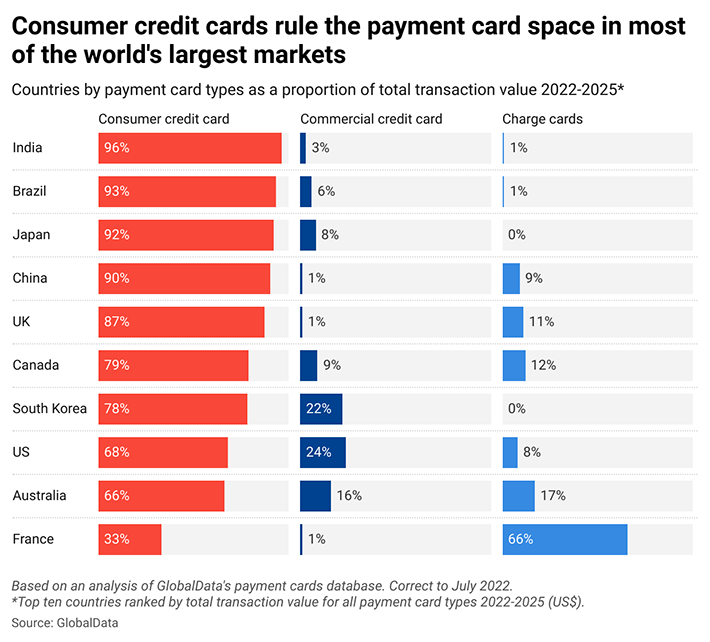

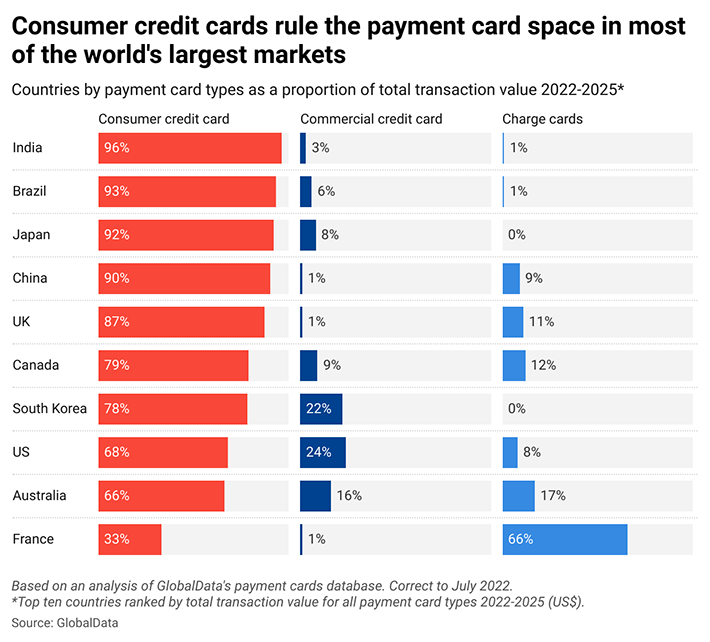

When it comes to card payments in general, our analysis revealed how consumer credit cards are forecast to remain the most popular method in the world’s largest markets. France is a notable exception, where charge cards account for most of the domestic market.

Yet with respect to the size of the opportunity for innovative instant payments solutions, the market leader is also forecast to be the world’s biggest market for payment cards over the next three years. China is expected to have a card market around twice the size of the USA, its nearest competitor.

As businesses and consumers alike begin to migrate from legacy commerce methods towards an increasingly diverse digital arena replete with a plethora of options and alternatives to traditional payment instruments, first-movers and early-adopters may find themselves ideally placed to outpace industry laggards. Instant payments are predicted to grow more rapidly than card payments in the future, making existing markets ripe for disruption by those willing to seize emerging opportunities.

Flexible futures

Flexible futures

As the financial services market and fintech solutions like IPS continue to evolve and grow, Vynamic™ Payments looks poised to be a genuine gamechanger in a buoyant industry driven by immediacy and relentless evolution.

Integration may also prove to be a key factor for the future of IPS, with GlobalData suggesting that technologies like Blockchain could be potentially assimilated by instant payment solutions to improve security and transparency. Malleable platforms like Vynamic™ Payments look ideally suited to such a synthesis.

A particularly important challenge is the need to develop robust new anti-fraud measures to protect consumers from being caught out by criminals when using instant payment methods, since funds cannot be recovered once transactions have been authorised. Vynamic™ Payments is already inherently well-placed to assist in this process given its ability to support any form of user authentication.

Another critical hurdle the financial services industry must overcome to adapt to a rapidly expanding IPS landscape is the need to embrace the transition to cloud computing. As highlighted in a

report by Ernst & Young, alternative payment methods are already “creating a potential threat” to the status quo. Incumbent banks risk being swept away by the rising tide of fintech innovation and are faced with an “urgency to modernize” legacy systems to compete with cutting-edge cloud-borne technologies.

EPI’s analysis of GlobalData’s fintech landscape analyser data suggests that the cloud-native payments space is still in its infancy and presents a significant opportunity for pioneering firms ready to steal a march on competitors. From a sample of approximately forty fintech products related to payments, over a third were cloud based whereas only five percent were explicitly listed as being cloud native. Most strikingly of all, a mere two percent were specifically described as cloud native and accommodating instant payments.

According to a

report by Heavy Reading, cloud native applications have considerable cross-sector advantages compared to alternatives, like enhanced speed to market, improved lifecycle management, and lower ownership costs. Vynamic™ Payments presents a tailor-made solution to ease the switch to digital for companies looking to claim a slice of the cloud-oriented payment pie by virtue of being fully cloud native.

Flexibility is the name of the game, and

Vynamic™ Payments’ inherently flexible architecture makes Diebold Nixdorf look set to be a major player in the burgeoning IPS revolution. The IPS trend is only speeding up the world’s wider movement away from cash, yet many markets currently face the challenge of dealing with newer digital methods alongside physical payments instruments. Leveraging its world-recognised ATM technologies and its newer Vynamic™ Payments architecture, Diebold Nixdorf’s portfolio presents a unique solution for seeing banks safely through these changing times.

Originally published by Electronic Payments International