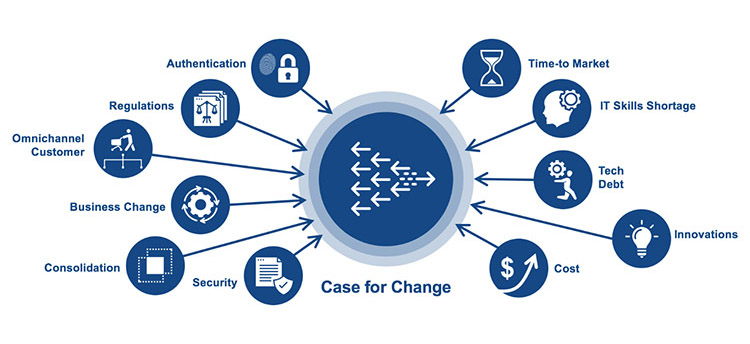

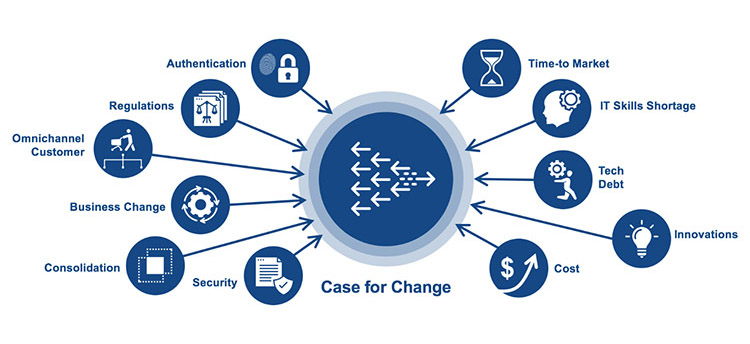

Financial institutions (FIs) are now confronting the effective end-of-life of their legacy payments systems. This is being driven by changes in consumer demands (which have been intensified by COVID), the emergence of new payment types and authentication methods, rising costs of processing card transactions, and competition from fintechs.

First-generation payments platforms weren’t designed for peer-to-peer transactions or instant payments from a watch; they were originally built to handle channel specific transactions such as swipe credit card purchases. As a result, innovations have been “jerry rigged” with a siloed infrastructure that now inhibits the ability to consolidate and provide the seamless omnichannel experience their consumers expect. Further, they slow down response to business change, new regulatory or compliance requirements, and security needs.

Until now, it has been possible to mostly keep up by releasing patches and occasional upgrades, but pressure has increased as the rate of change has accelerated. Today, driven largely by technology innovations and fintech startups, payment types are proliferating at a speed that is impossible for legacy platforms. The cost and time to change, test, and deploy new code without breaking existing code is becoming unsustainable.

How do you know if your platform is at its effective end-of-life?

-

Are you facing a slower time-to-market for new products and services?

-

Are your transactions processing at high cost?

-

Is change at risk of breaking the existing availability?

-

Are your technology initiatives failing to scale across the enterprise?

-

Is your current platform inflexible or resistant to change?

-

Are you having trouble finding the talent to maintain your legacy system?

If you find yourself confronting EEOL, now is the time to consider a payments platform that can meet today’s challenges, as well as whatever the future brings.

FIs don't have to remain tied to expensive infrastructure and resource-intensive payments platforms edging closer to their EEOL. Modernizing your payment system has the potential to unlock value through operational efficiencies, optimized customer experience, monetization of data, cost of payment operation, and new revenue streams.

What should you be looking for in a future-ready payments platform?

Cloud-native technology frees you from expensive and resource-intensive infrastructure

Microservices architecture enables you to seamlessly add services across all channels

Low-code environment speeds development, testing, and time to market

Continuous integration/continuous delivery (CI/CD) delivers updates quickly and safely

Modularity to use what is needed now with the ability to build for the future

Ability to integrate and scaffold with in-house applications

Capable of handling any current or future payment type, including crypto-currency

Smart routing to lower transaction costs

API integration to improve customer experience and facilitate open banking

Freedom to optimize performance and dashboard the experience

Diebold Nixdorf is leveraging our legacy of sustainable innovation in banking to empower FIs to leapfrog to the next generation in payments processing. We’ve created a disruptive payments innovation platform focused on real-time transaction processing in a cloud-native environment leveraging a modern, Open Banking API ecosystem. Creating value, cutting costs and enabling transformation in the areas where change is most intensive and accelerating. With Vynamic

TM Payments, banks can extend functionality in an agile CI/CD process as well as integrate 3rd party partner solutions in a state-of-the-art future-proven architecture.

Are you ready to take your payments platform into the future?

Learn more at DieboldNixdorf.com/Payments